Login to leave a review

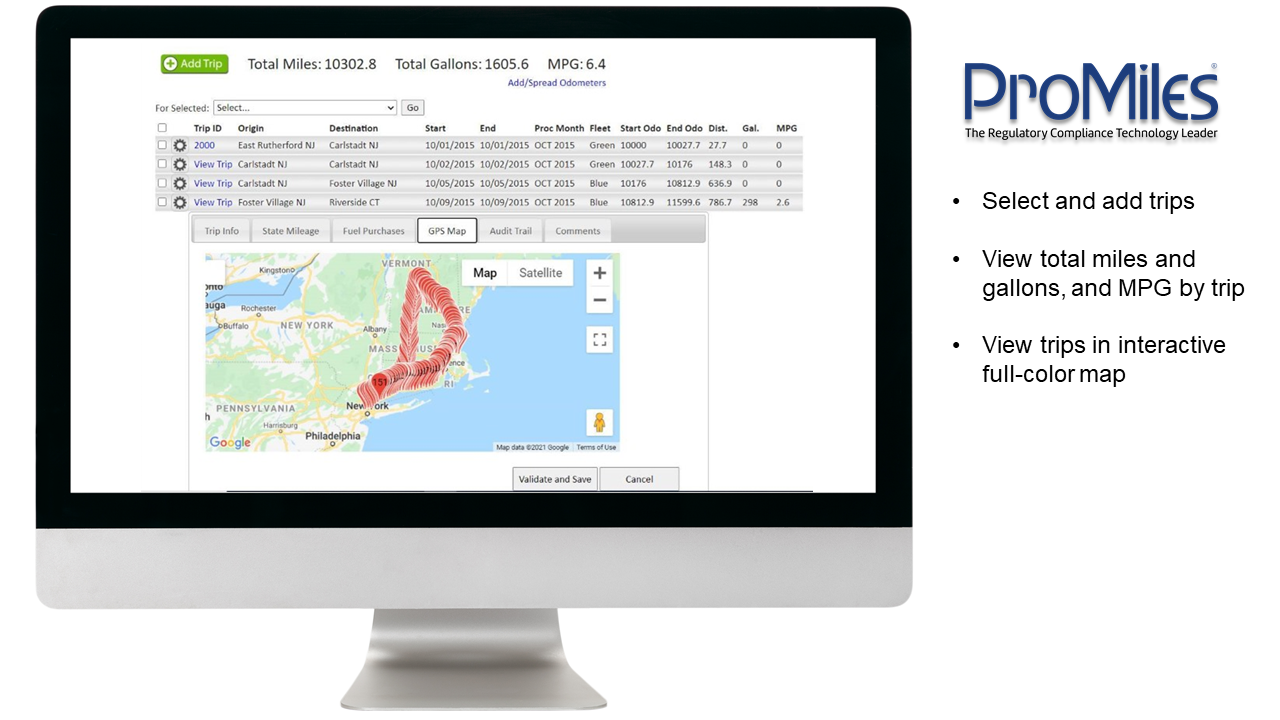

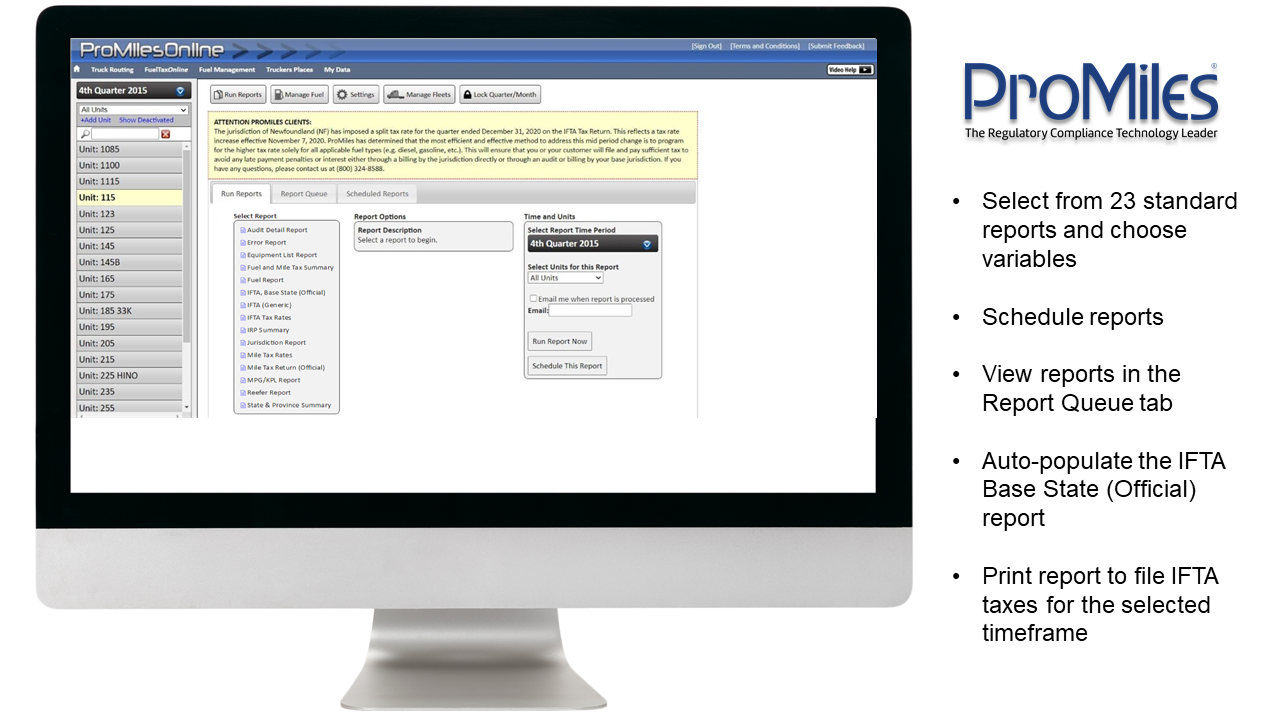

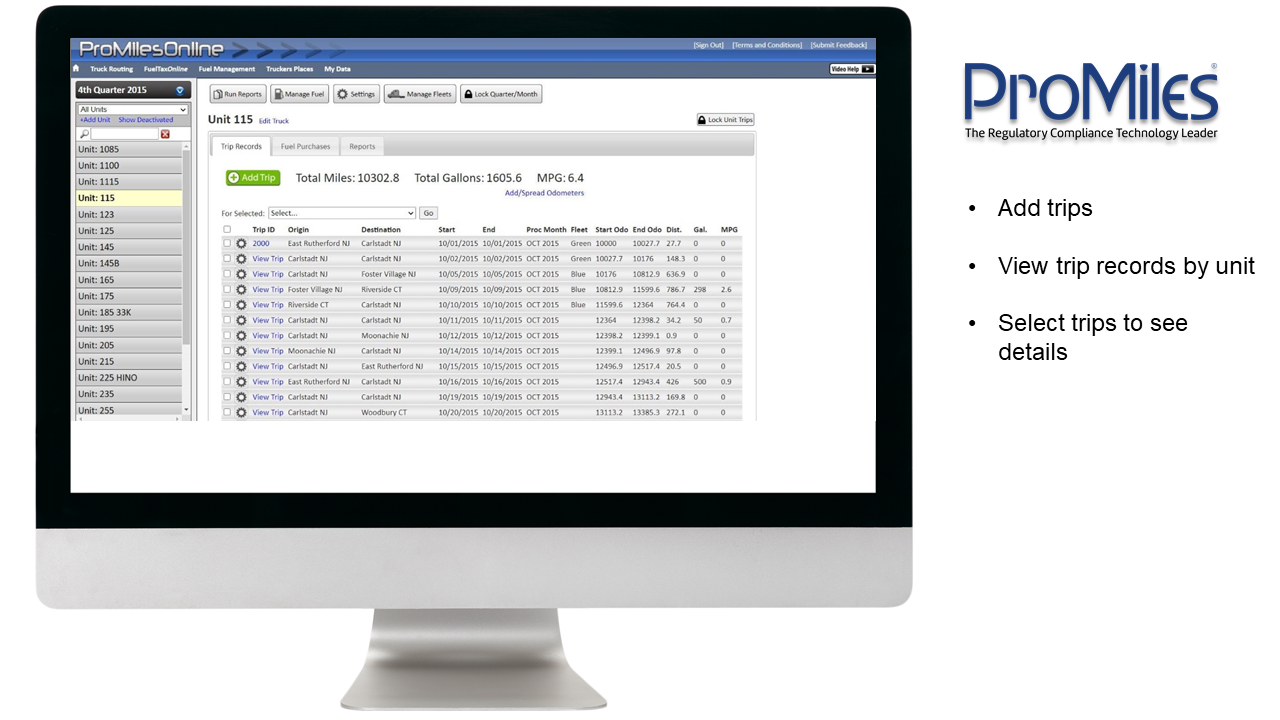

ProMiles Automated Fuel Tax Reporting (AFTR) solution is a state-of-the-art process, along with software applications, that uses GPS data to build pre-audit compliant trips within our industry-leading Routing Engine. Each trip is then placed into a web-based Fuel Tax account for fleets to review, edit and save. Once trips are uploaded, ProMiles imports all required fuel purchase information directly from the fuel card provider, assigns fuel information to trips, and creates reports, including IRP percentages, and State/Provincial IFTA and Mile Tax returns, and more.

Accurate, efficient and timely Fuel Tax reporting is one of the most challenging, and risky, regulatory compliance requirements for any trucking company to manage, with the process traditionally relying on driver records, manual data entry, past reporting methods and endless hours of tedious verification and reconciliation.

To combat this, ProMiles AFTR automates trip sheets, eliminating paper documents, missing trips, data entry errors, and the manual creation of reports, while mitigating risk in the event of an audit. Using the GPS data recorded by the Geotab GO device, you can help calculate the most accurate miles possible and build detailed trip records, including routes traveled, jurisdictional miles, and trip dates.

Features And Benefits

The AFTR system includes integration with Geotab products and most fuel card providers, an extensive suite of reports, and data symmetry with 98% of US State/DOT auditors who use ProMiles audit solutions to verify IFTA, Log Book and IRP compliance using the same AFTR mileage and routing calculations.

- Eliminate paper documents, missing trips, data entry errors and mitigate risk in the event of an audit

- Create reports within seconds that include: IFTA, Mileage Tax, and IRP percentages, Mileage by vehicle or division/fleet, State Adjacency/Odometer Errors, Owner-Operator Chargeback, MPG/KPL, Audit Detail, and more

- Archive trip histories for modification and deletion

- Ensure accuracy with ProMiles’ data validation and exception correction services

- Enjoy training and support provided by experts dedicated to user success

- Access ProMiles’ Audit Support services for professional support before, during and after an audit

- Archive data for 7 years or more

Device Plan Requirements

Base, GO

Company Website

https://promiles.com/aftr/Regions

Canada

United States

Supported Languages

English